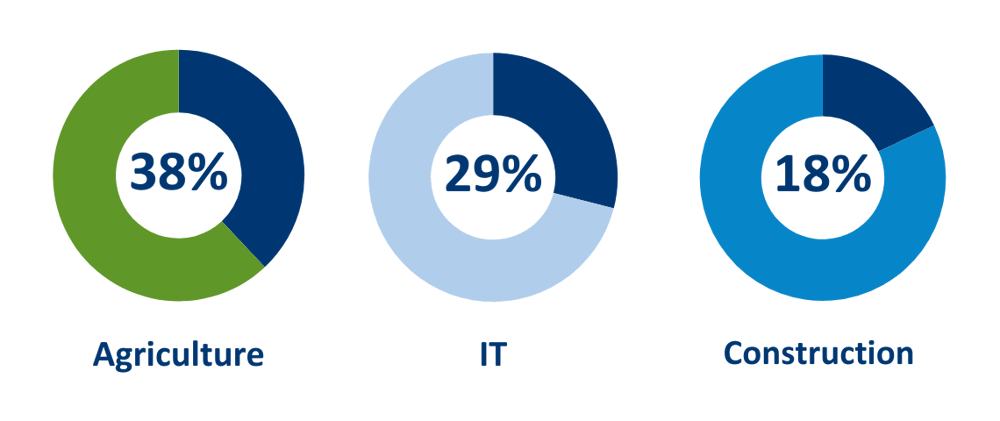

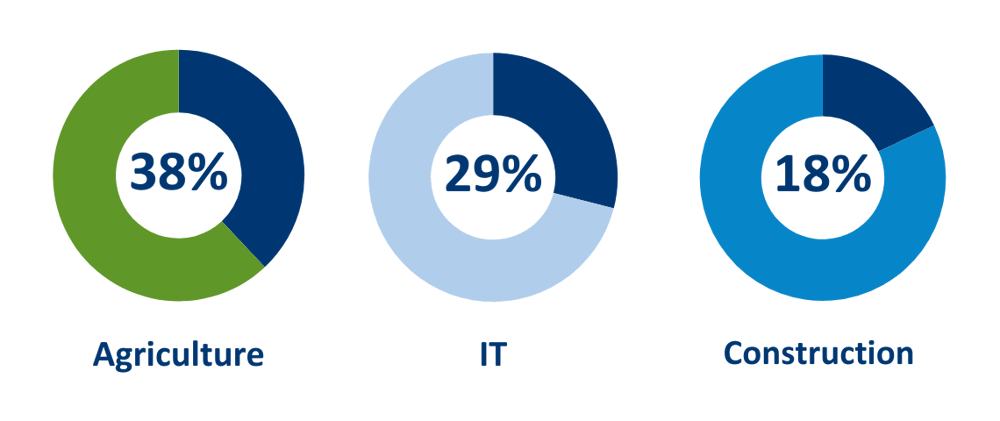

Agriculture (38%), IT (29%) and construction (18%) saw the largest year-on-year increases, reflecting the urgent demand for housing and infrastructure. Meanwhile, key sectors such as wholesale/retail (9%) and hospitality (5%), remained major contributors to the record-breaking figures.

Regional Highlights: Entrepreneurship Beyond the Capital

While Dublin accounted for over 40% of all new companies with 11,450 start-ups, there was growth across the country. Amongst the highest rate of startups included Cork added 2,552 new firms, followed by Galway (1,145), Kildare (1,124), and Meath (1,018). Desire to reduce reliance on global multinationals amid geopolitical uncertainty

The 2025 figures exceed the previous post-Covid peak of 25,692 recorded in 2021.Traditionally, periods of record-low unemployment can dampen start-up activity; however, current trends point to a strong and growing appetite for indigenous enterprise.

This reflects a strategic shift to reduce reliance on global multinationals amid heightened geopolitical uncertainty, global tariff concerns and evolving trade relationships.

At the same time, tighter credit conditions, rising corporate stress, housing pressures, an ongoing cost-of-living burden and increased volatility in export markets may be contributing to elevated stress indicators. Without targeted support, this momentum could stall, leaving Ireland’s continued dependence on multinationals exposed.